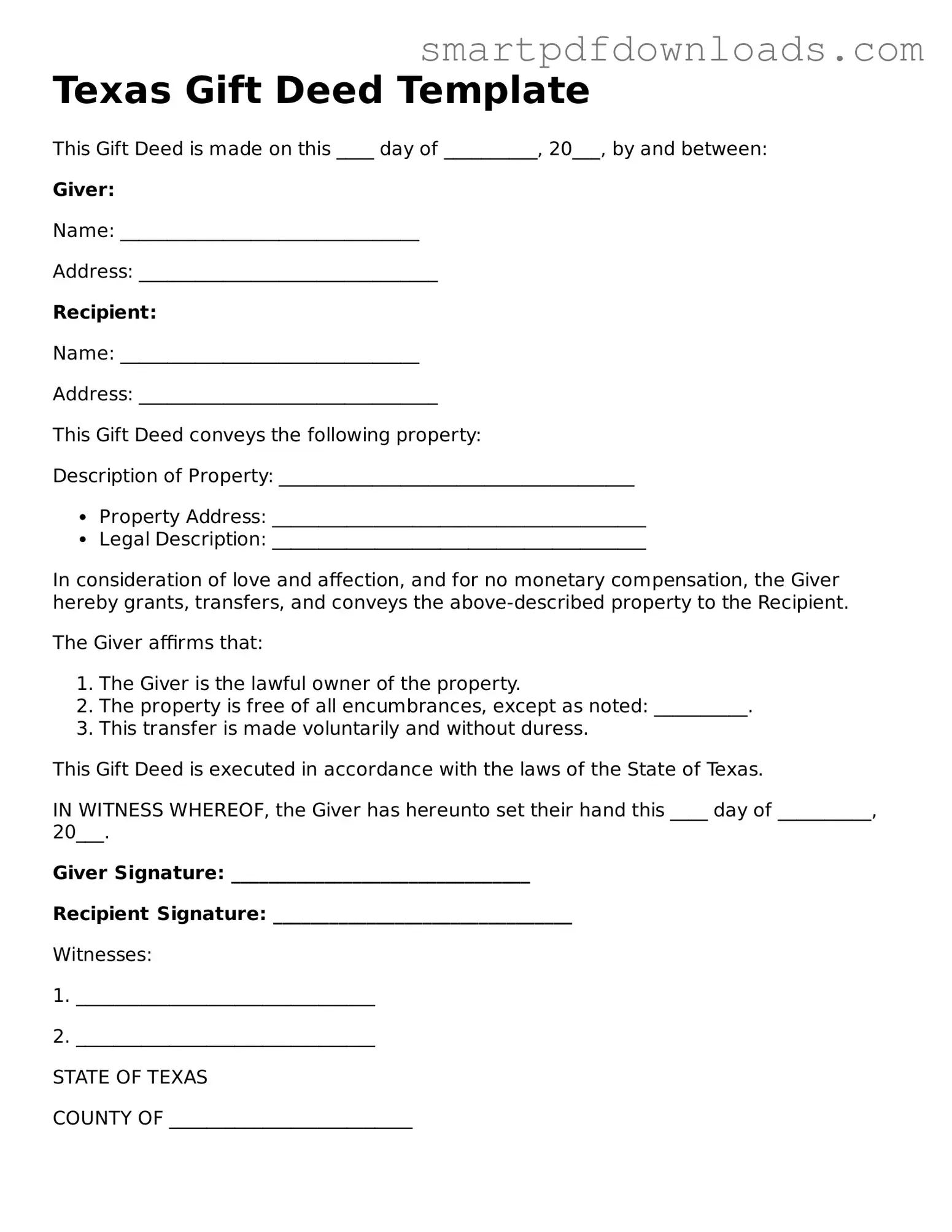

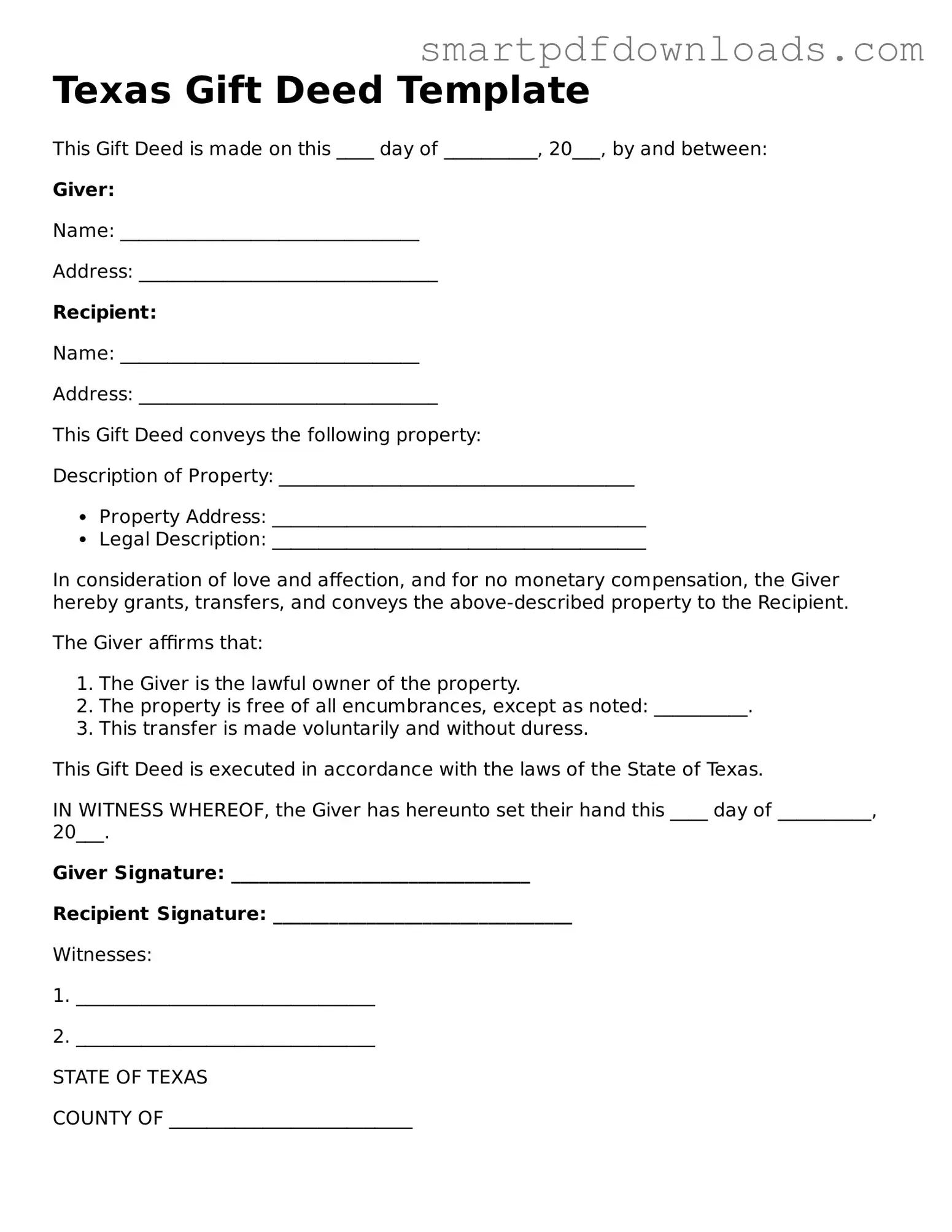

Legal Gift Deed Form for the State of Texas

A Texas Gift Deed form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is essential for individuals wishing to give real estate as a gift, ensuring that the transfer is recognized by the state. Properly executed, it provides clear evidence of the donor's intent and the recipient's new ownership rights.

Edit Gift Deed Online

Legal Gift Deed Form for the State of Texas

Edit Gift Deed Online

Edit Gift Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Gift Deed online fast, without printing.