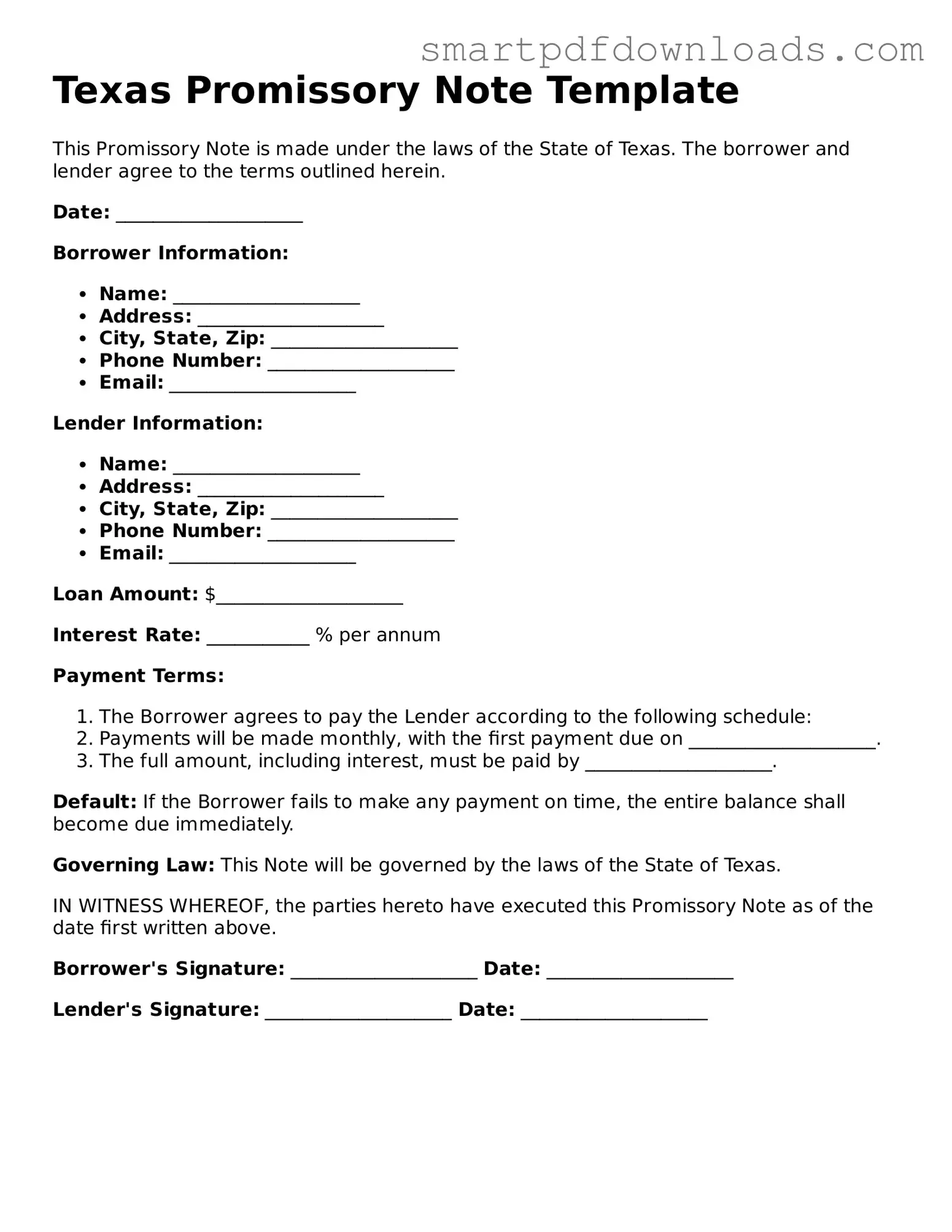

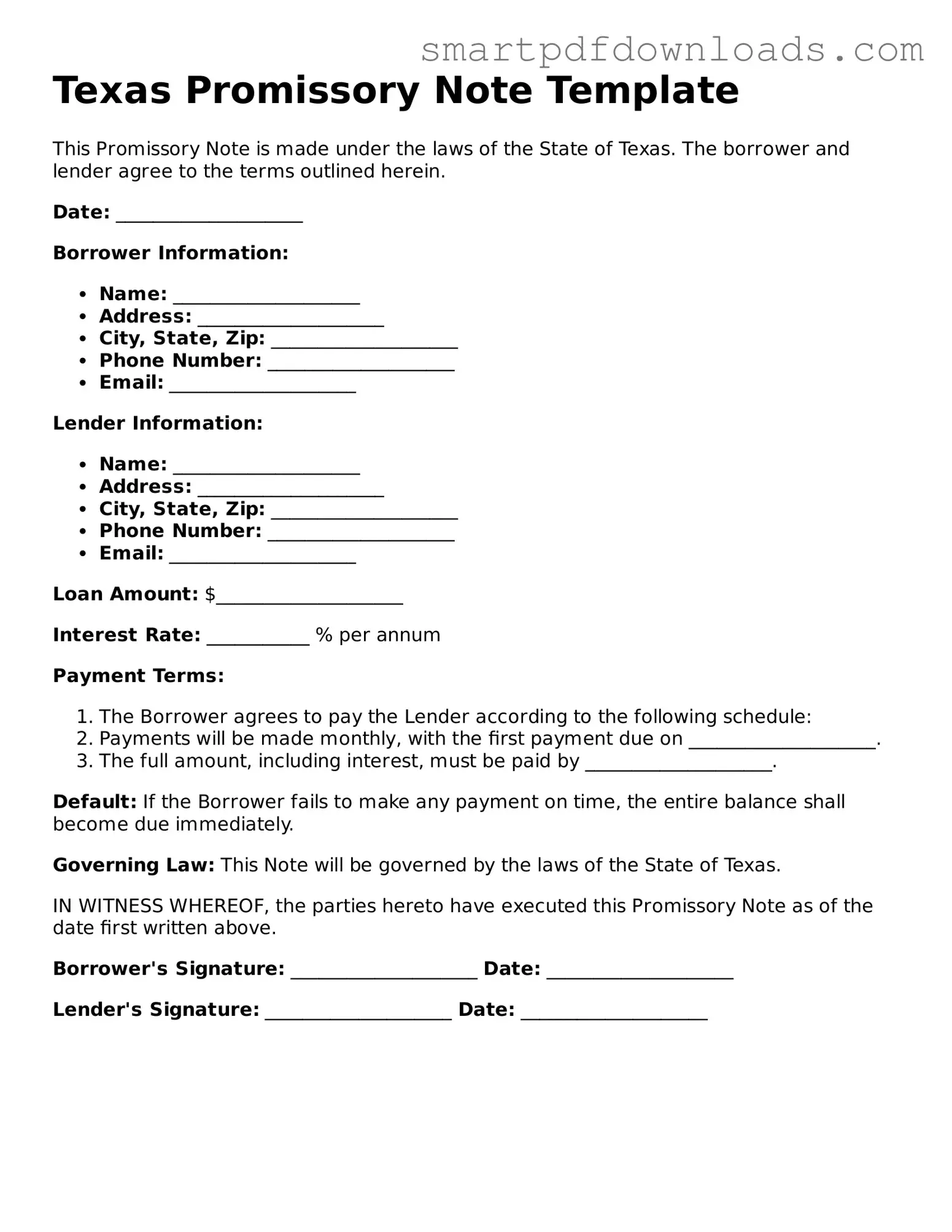

Legal Promissory Note Form for the State of Texas

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specific terms. This form serves as a clear record of the debt and helps protect both parties involved. Understanding its components can empower you to navigate the lending process with confidence.

Edit Promissory Note Online

Legal Promissory Note Form for the State of Texas

Edit Promissory Note Online

Edit Promissory Note Online

or

⇓ PDF File

Finish the form and move on

Edit Promissory Note online fast, without printing.