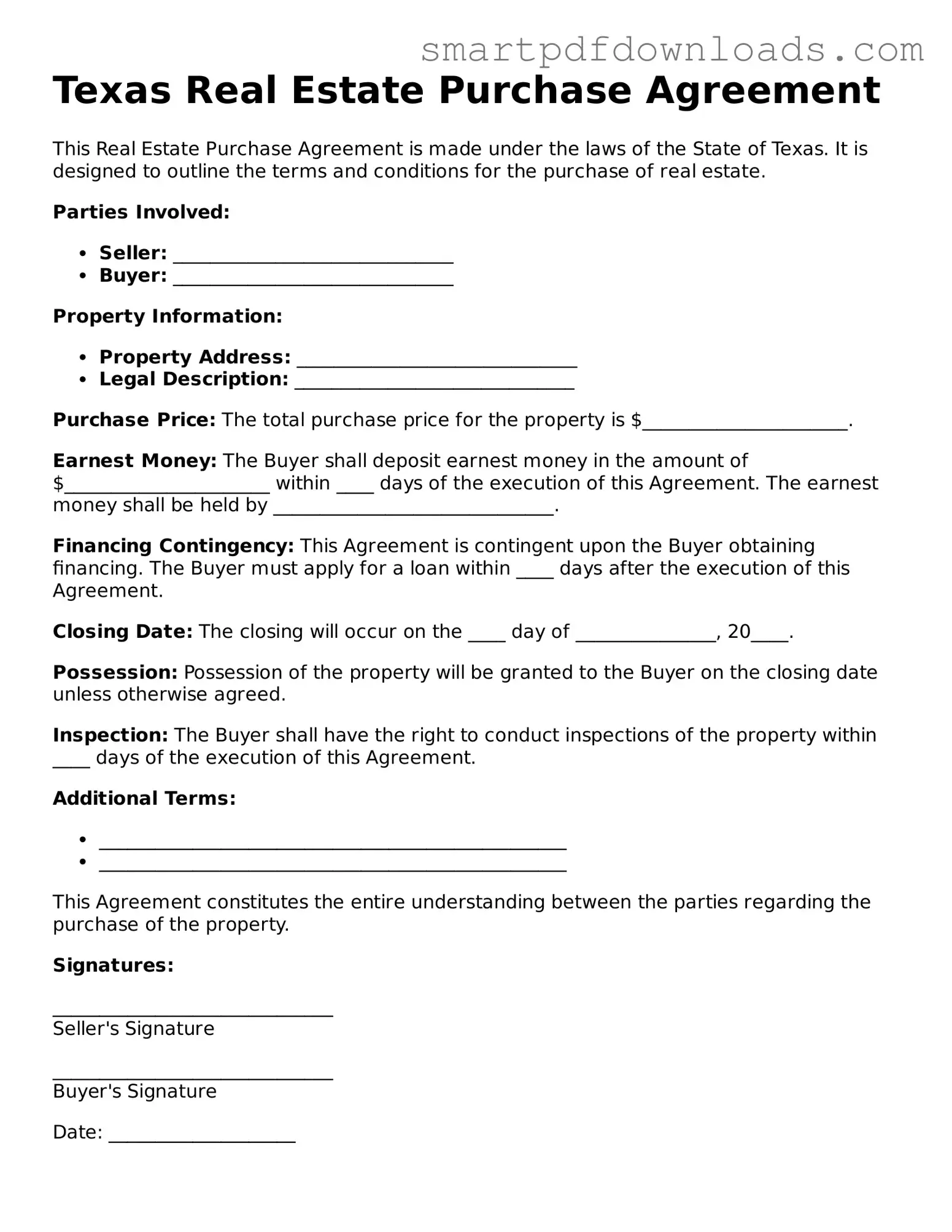

Legal Real Estate Purchase Agreement Form for the State of Texas

The Texas Real Estate Purchase Agreement form is a legally binding document used to outline the terms and conditions of a real estate transaction in Texas. This form serves as a critical tool for buyers and sellers, ensuring that both parties understand their rights and obligations. By clearly detailing the specifics of the sale, the agreement helps facilitate a smoother transaction process.

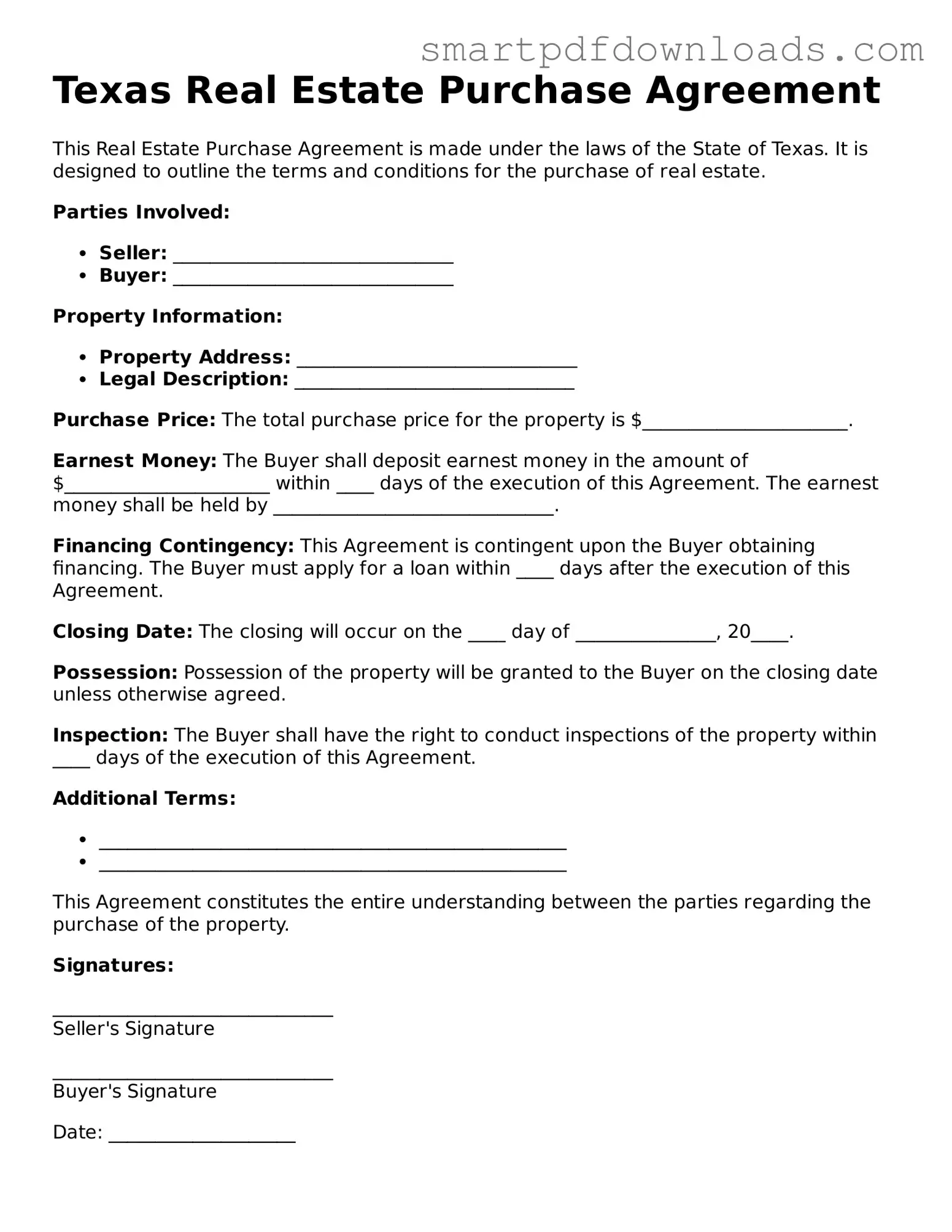

Edit Real Estate Purchase Agreement Online

Legal Real Estate Purchase Agreement Form for the State of Texas

Edit Real Estate Purchase Agreement Online

Edit Real Estate Purchase Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Real Estate Purchase Agreement online fast, without printing.