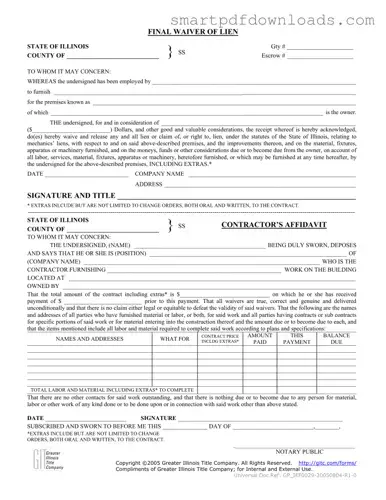

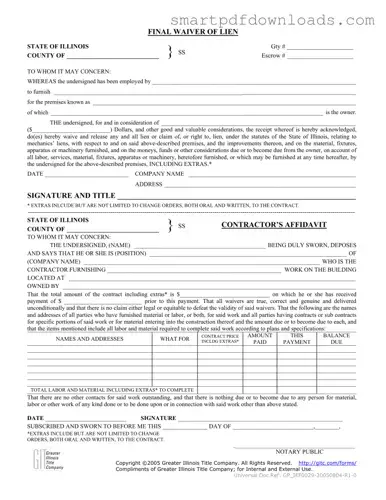

The Illinois Final Waiver of Lien form is a legal document that allows a contractor or subcontractor to waive their right to file a lien against a property. This waiver is typically executed after payment has been received for services...

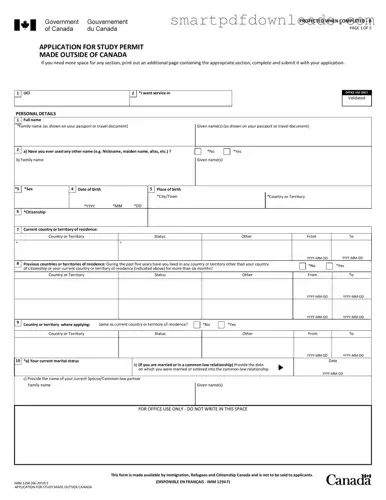

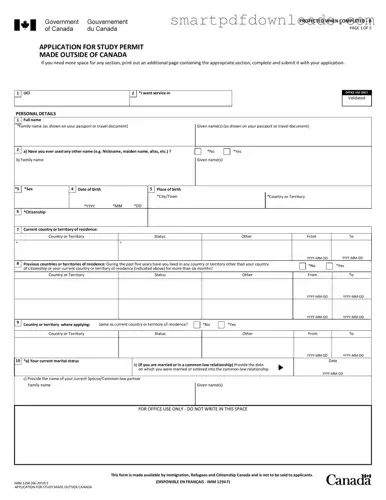

The IMM 1294 form is an essential application used by individuals seeking a study permit to attend educational institutions in Canada from outside the country. This form collects vital personal information, educational details, and background history to assess eligibility for...

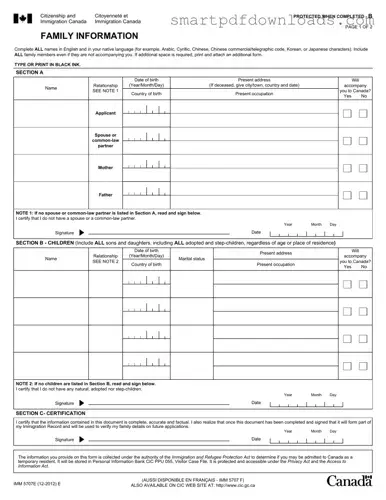

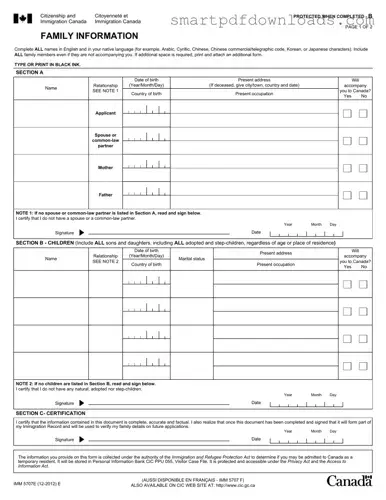

The IMM 5707 form is a crucial document required by individuals applying for a Temporary Resident Visa to Canada. This form collects essential family information, ensuring that all family members are accounted for, regardless of whether they will accompany the...

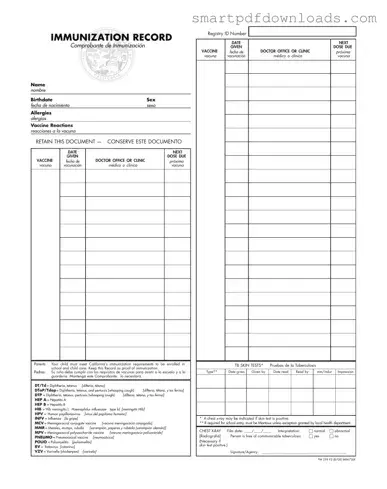

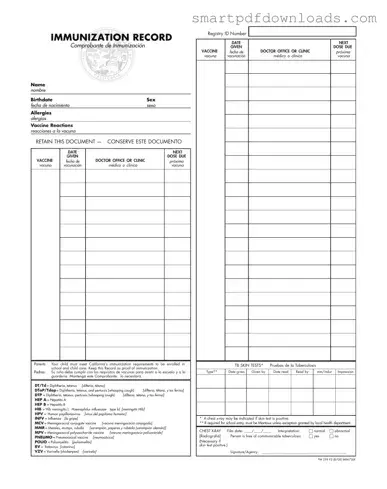

The Immunization Record form serves as an official document that tracks an individual's vaccination history. This form is crucial for parents, particularly in California, as it ensures their children meet the state's immunization requirements for school and child care enrollment....

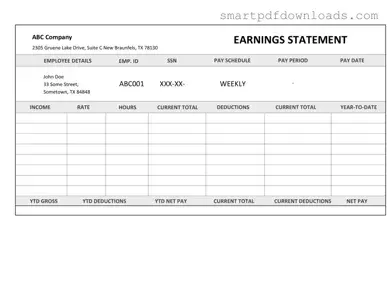

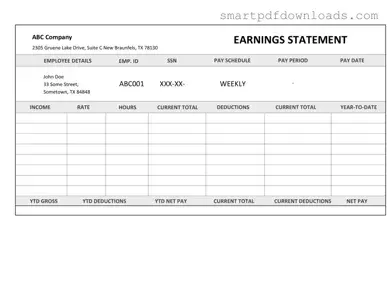

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment for services rendered, providing transparency for both the contractor and the hiring entity. Understanding...

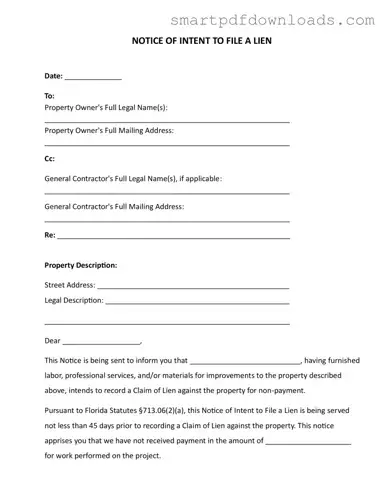

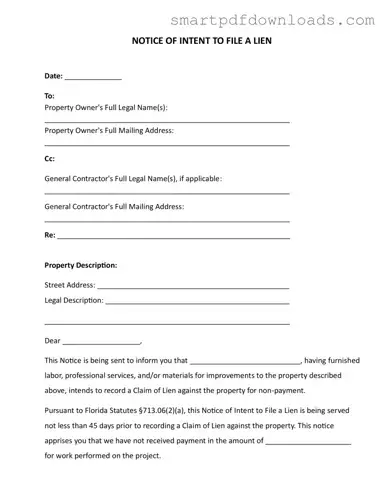

The Intent To Lien Florida form serves as a crucial notification for property owners, alerting them of an impending claim against their property due to non-payment for labor or materials provided. This form is essential in the construction and renovation...

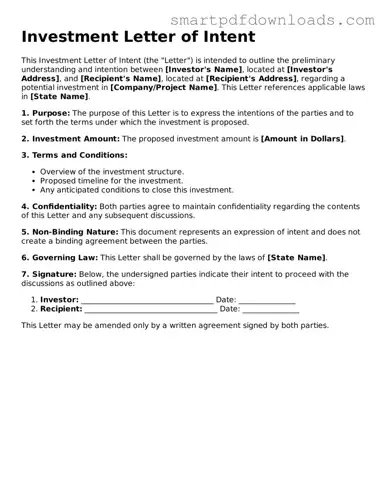

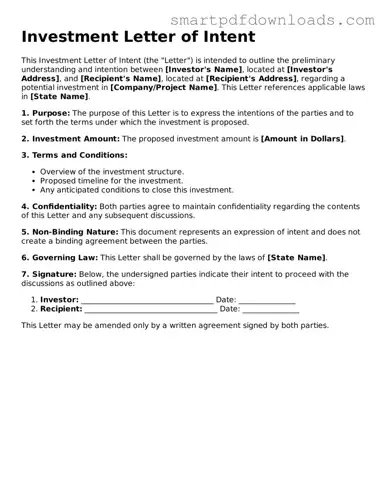

An Investment Letter of Intent form is a document that outlines the preliminary agreement between parties interested in making an investment. This form serves as a starting point for negotiations and helps clarify the intentions of the involved parties. By...

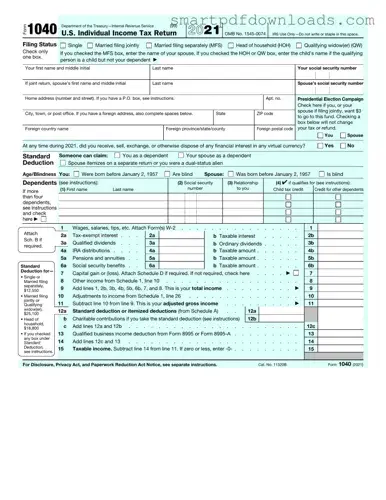

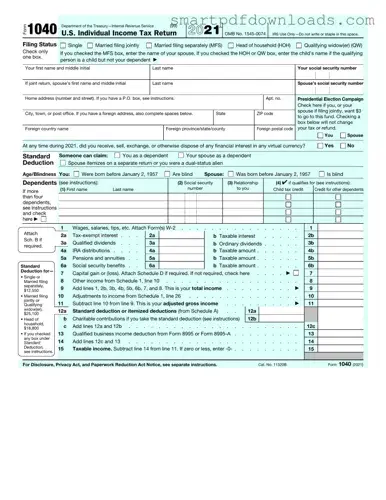

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income and calculate their tax obligations. This form allows individuals to detail various sources of income, claim deductions, and determine their...

The IRS 1095-A form is a crucial document that provides information about health coverage obtained through the Health Insurance Marketplace. This form helps individuals and families report their health insurance status when filing their federal tax returns. Understanding the 1095-A...

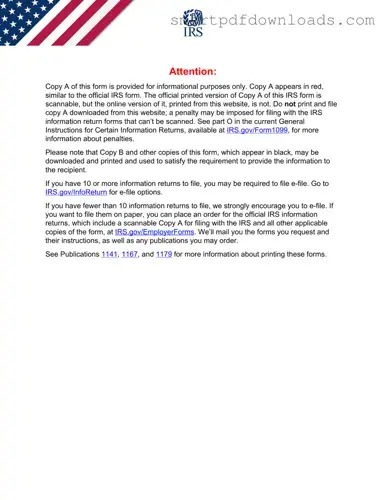

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals or businesses that are not classified as wages or salary. This form is essential for freelancers, independent contractors, and other non-employees who...

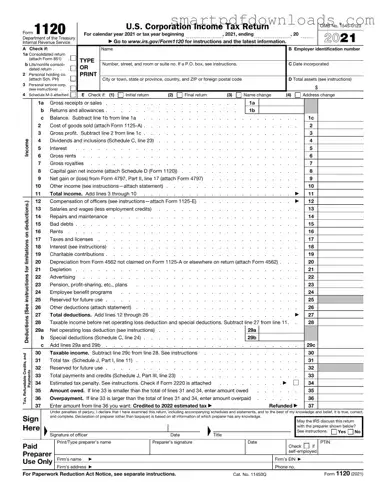

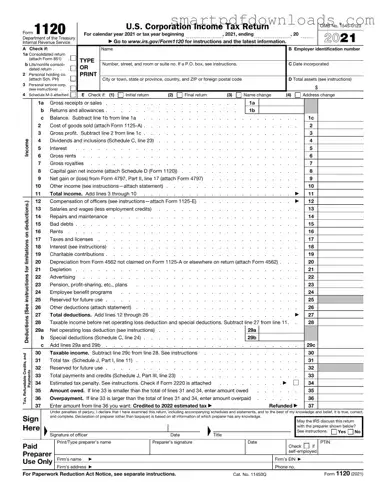

The IRS 1120 form is the U.S. Corporation Income Tax Return, which corporations use to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for corporations to calculate their tax liability and...

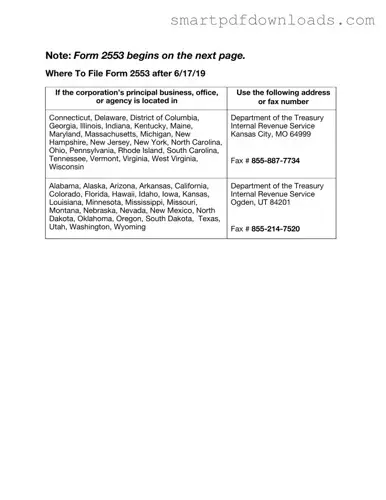

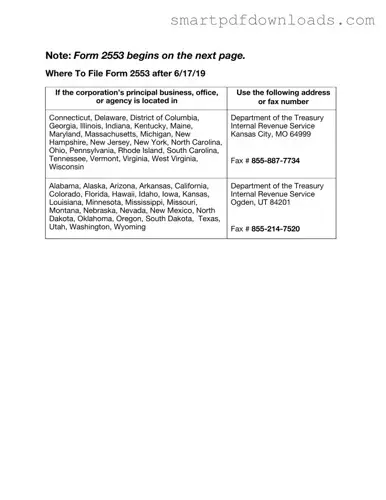

The IRS Form 2553 is a crucial document used by small businesses to elect to be treated as an S corporation for federal tax purposes. This form allows eligible corporations to pass income, losses, and deductions directly to shareholders, potentially...